Maximum Deferred Comp 2025 Including Catch Up. The 2025 401 (k) individual contribution limit is $23,000, up from $22,500 in 2025. As part of a 457 plan, participants can contribute more than the annual limit once they reach a certain age.

The maximum annual contribution limit for 457 (b) plans is $23,000 for 2025 (or 100% of gross annual compensation, if less). The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2025.

Deferred Compensation Limits 2025 Andy Maegan, The 2025 401 (k) individual contribution limit is $23,000, up from $22,500 in 2025.

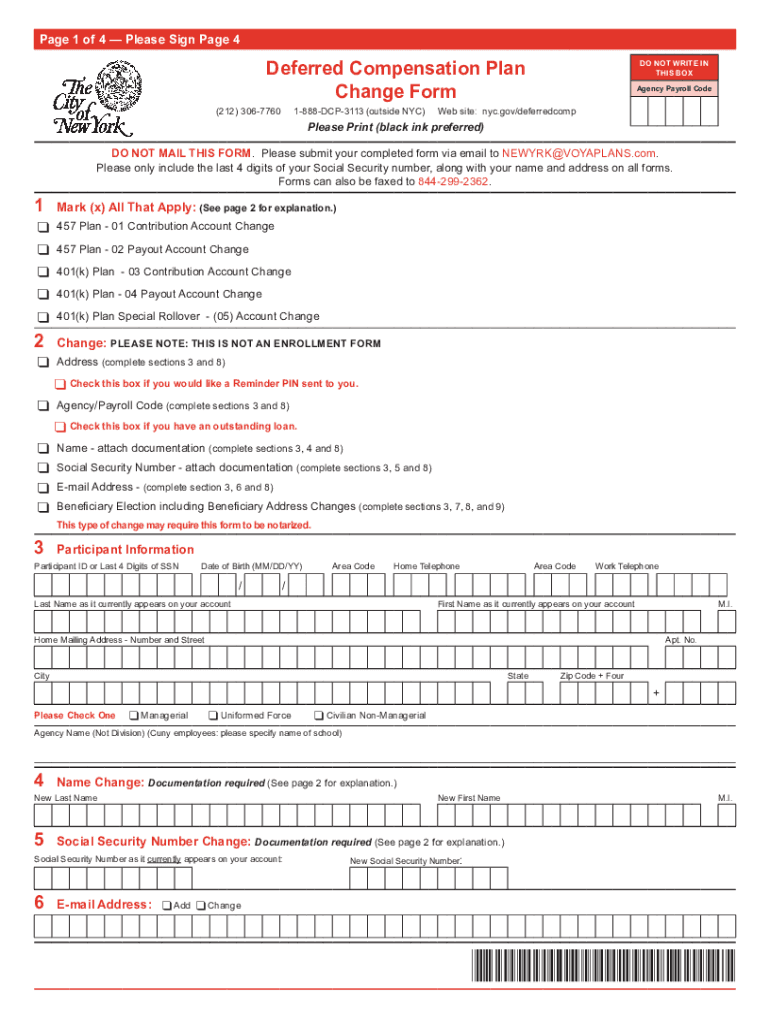

20212024 NY Deferred Compensation Plan Change Form Fill Online, The maximum deferral limit refers to the annual amount that an employee can defer from their pay to a 401 (k) plan.

457 Deferred Compensation Plan Limits 2025 Colly Rozina, The maximum deferral limit refers to the annual amount that an employee can defer from their pay to a 401 (k) plan.

Deferred Compensation Florida Department of Financial Services, Understanding irs contribution limits is important, especially when your goal is to contribute the maximum to your account.

Irs Hsa Catch Up Contribution Limits 2025 Mandy Kissiah, Employees age 50 or older may contribute up to an.

457 Deferred Compensation Plan Limits 2025 Colly Rozina, The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2025.

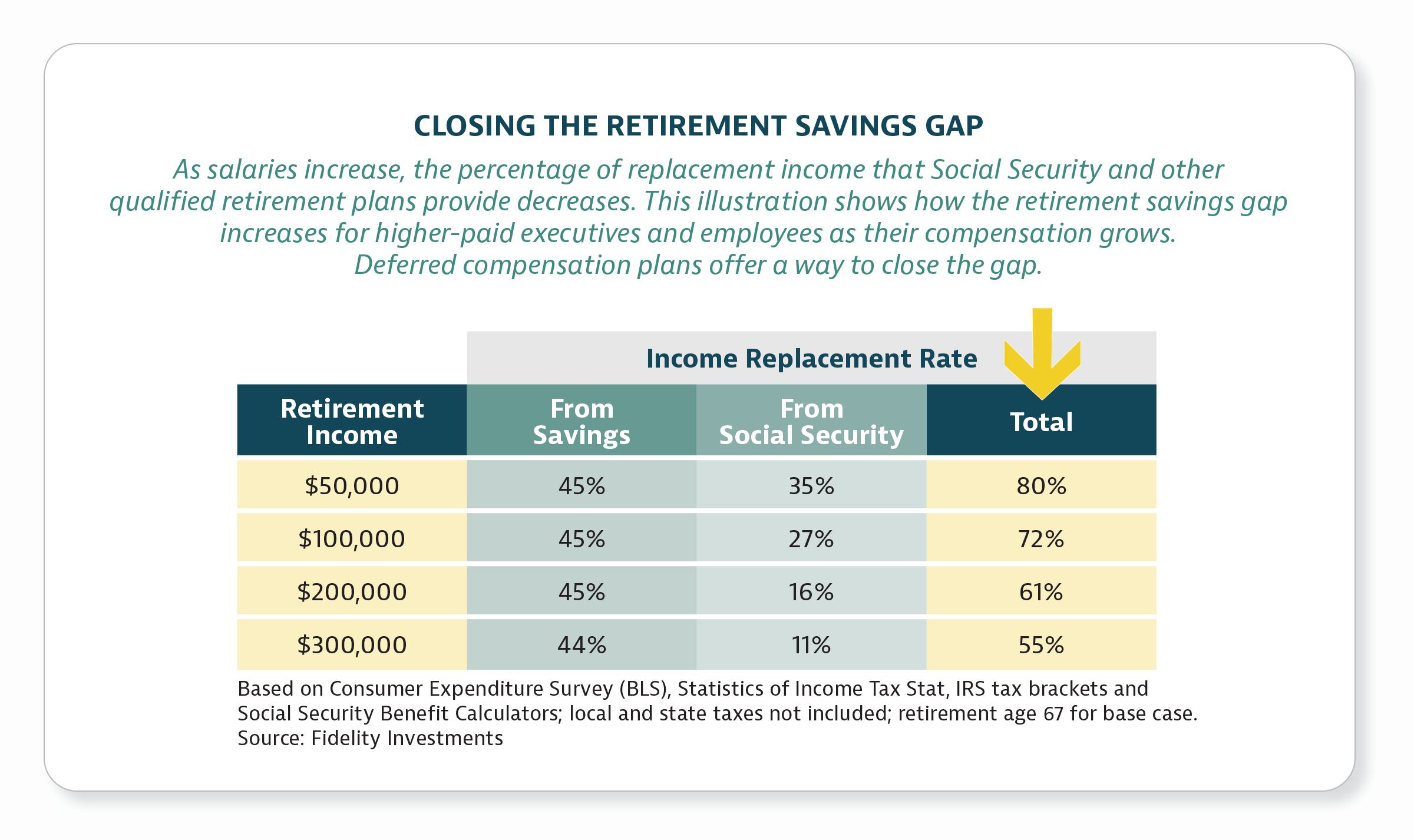

Deferred Compensation Plans Definition, Types, Choosing One, The maximum annual contribution limit for 457 (b) plans is $23,000 for 2025 (or 100% of gross annual compensation, if less).

Nonqualified Deferred Compensation Plans What To Know, That’s an increase of $1,000 over 2025.